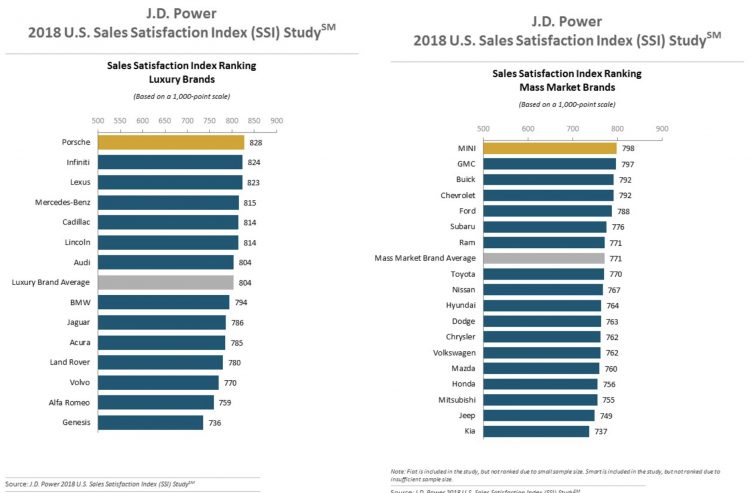

Porsche has topped the US 2018 J.D. Power Sales Satisfaction Index study for luxury car brands, jumping three spots from last year. MINI came out on top for the mass market car brands. This is good news for the brands as these studies are compiled together from huge pools of direct customer feedback.

The legendary Germany sportscar brand racked up 828 points in the study this year, which is made up of a 1000-point scale. This is up 10 points on last year, when Porsche placed fourth. Infiniti came in second place for the luxury brands with 824 points, leaving the often top-running Lexus brand to third spot with 823 points.

Last year’s leader, Lincoln, scored 814 points, moving it down to sixth place for luxury brands. At the bottom of the pack is Volvo with 770 points, and then Alfa Romeo with 759 points, and in last place Genesis with 736 points.

As for the mainstream brands, MINI takes home the gold with 798 points. It jumped from second place last year to first. Even so, this year’s score is actually down five points from last year. GMC brought home second spot with 797 points, equalling Chevrolet, giving third place to Ford with 788 points.

This year’s study comprised of answers from 25,748 buyers who purchased a vehicle in April or May. It looked at six main criteria, including dealer staff, delivery process, paperwork, the deal, the showroom, and the showroom website.

Things seem to be improving for the mass market segments, with the average score rising five points to 771 this year. Meanwhile, luxury brands appear to be falling behind slightly, with the average dropping two points to 804 for this year.

In a statement, J.D. Power said it is noticing that more and more buyers are appreciating digital communication, such as text messaging, although the medium isn’t being used as often as customers desire. Chris Sutton, vice president of the automotive retail practice at J.D. Power, said that for younger customers, this is how they engage.

“Automotive dealerships are slowly moving toward more frequent digital communication, but as customers come to expect this opportunity for engagement, dealers need to pick up the pace for incorporating texting and emailing into the day-to-day sales process.”

The firm finds that overall satisfaction in several studies is normally higher among customers who communicate via text messaging. However, face-to-face communication is still the most common form of contact between buying customers and dealers. Specifically, 89 per cent of the time in luxury segments and 90 per cent in the mainstream market.