Californian electric vehicle maker, Rivian, has seen its share price hit by a steep drop after recalling 13,000 vehicles for a potential safety issue which accounted for 92 per cent of its overall deliveries.

Rivian started producing customer orders in the third quarter of 2021, and has so far delivered 13,198 vehicles – 12,200 of which have been implicated in the safety recall, related to a potential steering issue.

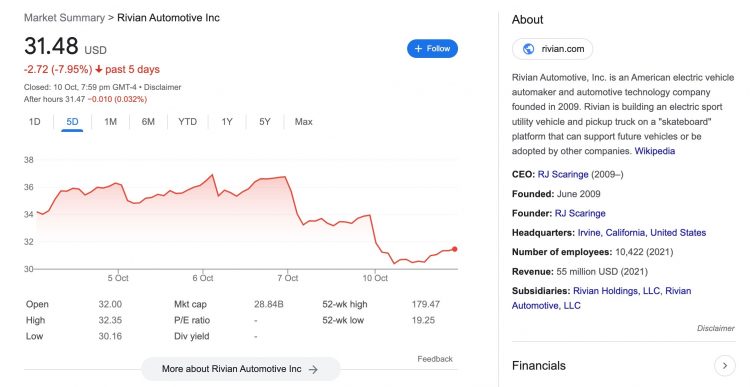

News of the recall has sent Rivian’s share price tumbling, closing 7.3 per cent down yesterday that wiped $2 billion from its $31.1b market cap, according to Google Finance records.

With a wider view, Rivian’s share price is down 18.74 per cent for the month, 20.30 per cent down over six-months and down a staggering 75 per cent since its IPO back in November, 2021, where it hit the market at a price of $129.95.

According to documents submitted by Rivian to the National Highway Traffic Safety Administration, the company says that less than 1 per cent of its vehicles could be prone to steering issues from a loose fastener.

Rivian says that the loose fastener could create significant vibrations through the steering rack, and in some cases, cause a steering malfunction.

The company says that the recall should take around a month, while the repair takes a few minutes to complete. Rivian says: “The safety of our customers will always be our top priority.”

Rivian added: “To date, we are not aware of any injuries that have resulted from this issue.”

Earlier this year, Rivian was forced to adjust its production estimates to 25,000 units for the year. We’ll have to see how the latest recall impacts Rivian’s momentum when it posts the next set of quarterly earnings and deliveries.

Rivian is planning to enter the Australian market and has begun accepting orders. Local deliveries are expected to commence in by around 2024.